Knowledge transfer is not limited to a simple exchange of documents: it is pivotal to operational continuity, cost control, and risk management. Far too often, the absence of a structured handover process leads to productivity loss, technical debt, and budget overruns.

Anticipating this transfer from day one of the project ensures scalability, reduces reliance on a single individual, and embeds handover within clear governance. This approach guarantees that handover isn’t merely a milestone, but a lever for long-term stability and performance.

Anticipating the Handover from Project Inception

The handover is structured from the very first milestone, not at the end of development. It relies on living documentation, clear standards, and shared governance.

Structured Documentation from Day One

Establishing a documentation repository during the project’s ideation phase captures business context, objectives, and constraints from the start. Every feature, every API, and every component has its place in a continuously updated README or collaborative portal.

This practice prevents newcomers from diving into code without understanding the “why” behind design choices. Updated documentation serves as a guide to understand key dependencies and interactions within the project.

In practice, a major player in the Swiss logistics sector implemented an internal portal at kickoff to centralize requirements and diagrams. The result: a 40% reduction in onboarding time for each new hire and a significant drop in repetitive questions during development phases.

Unified Governance and Standards

Defining code conventions, API naming rules, and the Git workflow at project launch ensures consistency throughout the software lifecycle. Every contribution then adheres to the same stylistic and structural guidelines.

This uniformity facilitates code reviews, pull request assessments, and cross-reviews among developers. It’s especially crucial when multiple vendors or teams work simultaneously.

A Swiss fintech service provider formalized its style guides in a repository accessible to all. This initiative eliminated 70% of convention-related anomalies and streamlined collaboration between internal and external stakeholders.

Access Management and Controlled Environments

Controlling permissions on repositories, test servers, and third-party tools from project inception prevents bottlenecks down the line. Each role is defined, every access is traceable, and the boundaries of environments (development, staging, production) are documented.

Access traceability enables anticipating team changes and securing delivery continuity. It prevents situations where a former collaborator retains essential keys, which could block or compromise a deployment.

A mid-sized Swiss watchmaker implemented an access policy based on a centralized directory from the design phase. When the lead developer left the project, their permissions were reviewed within hours, without impacting the roadmap or delivery deadlines.

Securing the Foundation Before Handover

A documented and standardized foundation reduces onboarding time and prevents misunderstandings. It lays the groundwork for controlled evolution.

Centralizing the Project Repository

Gathering all relevant information in a single space ensures that every team member accesses the same source of truth. A structured, accessible, and versioned documentation portal eliminates the proliferation of disparate materials.

This centralization encompasses requirements specifications, functional specifications, flow diagrams, and deployment instructions. It provides complete transparency on the project’s status in real time.

A Swiss public institution created an internal wiki to track updates to its in-house application. This initiative reduced clarification meetings by 60% and allowed critical decisions to be identified earlier.

Recording Architectural Decisions

Documenting every technical choice (ADR – Architectural Decision Record) clarifies the context and rationale behind it. Decisions on hexagonal architecture and microservices, framework selection, or third-party component integration are then traceable.

Without records, these decisions become opaque and are lost when teams change, often leading to repeated mistakes or increased technical debt. An ADR lists the alternative considered, the reason for rejection, and the impact on the project.

A Swiss training organization maintained an ADR log for each major version of its LMS. When the IT manager changed, the new team could continue work without revalidating already documented choices, saving several weeks of analysis.

Automating Tests and CI/CD Pipelines

Implementing automated testing and continuous delivery processes from the outset secures every change.

The CI/CD pipelines validate code, run unit and integration tests, and ensure stability before any production deployment.

These mechanisms act as a shield against regressions and serve as an effective handover support: a new contributor receives instant feedback on the impact of their changes.

{CTA_BANNER_BLOG_POST}

Structuring the Active Transfer Phase

Handover is an overlapping phase where active knowledge transfer takes precedence over mere document handoff. A formal schedule and hands-on exchanges strengthen project continuity.

Formal Transition Planning

Establishing a detailed handover schedule with overlap dates, key contacts, and clear objectives ensures rigorous tracking. Each step, from deliverable delivery to final approval, is contractual and scheduled.

This schedule also defines the duration of overlap between the outgoing and incoming contributors, allowing for a gradual transfer of responsibilities and rapid identification of risk areas.

In a digitalization project for a regional Swiss bank, this formal planning prevented interruptions of critical services by ensuring a two-week overlap between the outgoing vendor and the new team.

Peer Programming and Active Transfer

Implicit knowledge sharing occurs primarily during direct exchanges: peer programming sessions, collaborative code reviews, and code walkthrough demonstrations.

These hands-on sessions reveal the nuances of internal workings, debugging habits, and optimization tricks that are not always documented.

A Swiss company in the healthcare sector organized peer programming workshops to transfer the culture of its patient microservice. This method enabled the new team to deeply understand processing logic and halved the familiarization time.

Verifying Access and Essential Deliverables

Before the end of the transition period, it’s crucial to verify that all accesses (code, environments, third-party tools) have been transferred and that deliverables are complete and functional.

A quick audit of accounts, SSH keys, and SSL certificates prevents omissions that could paralyze the project after the departure of the outgoing collaborator.

In a payment system overhaul for a Swiss retail chain, this verification uncovered a forgotten service account. Its prompt recovery avoided several days of downtime and protected data integrity.

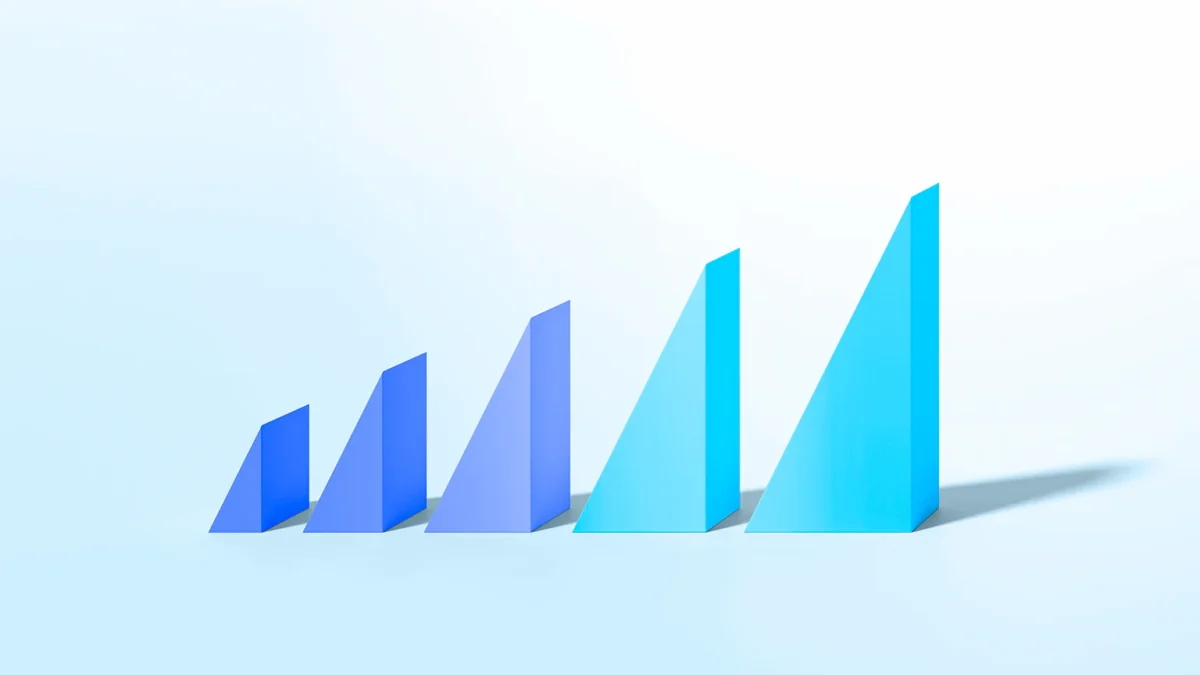

Measuring Impact and Enhancing Scalability

Handover isn’t a cost but an investment to be leveraged through clear metrics. A mature transfer strategy becomes an asset for agility and scalability.

Tracking Continuity Metrics

Implementing metrics such as average onboarding time for a new developer, the number of post-handover incidents, or adherence to deployment schedules allows quantifying handover effectiveness.

These metrics feed governance reviews and guide adjustments to the process: documentation, additional training, or tool optimization.

A Swiss IT services company implemented a dashboard to track these KPIs. After two handover iterations, it observed a 30% reduction in critical incidents related to transfer errors and adjusted its internal training program.

Reducing Individual Dependency

The ultimate goal of a successful handover is to avoid leaving a ‘knowledge silo’ in a single person’s hands. By systematizing documentation and exchanges, knowledge is dispersed across the team.

Regular role rotation, combined with shared code reviews, reduces the share of tacit knowledge held by any single contributor and strengthens project resilience.

A Swiss financial institution introduced quarterly “tech breaks” where each member documents a part of the system. Since then, dependency on the lead developer during critical phases has been cut by two-thirds.

Promoting New Talent Integration

A well-designed handover accelerates the ramp-up of new hires or incoming contractors. Clear documentation, reproducible environments, and automated tests provide a reassuring framework for taking over quickly.

Each newcomer can focus on delivering value rather than discovering the codebase, which increases team agility and delivery speed.

A mid-sized Swiss e-commerce site onboarded three new developers thanks to a meticulous handover. Their productivity reached the expected level in the first week, demonstrating that transfer strategy is a lever for scalability.

Turning Handover into Sustainability Assurance

Anticipating handover from the start, building a solid foundation, organizing an active transition, and measuring its effects transforms handover into a true performance lever. This continuous process protects the investment, limits risks, and enhances the agility of your IT system.

Our experts are available to co-design a tailored handover strategy adapted to your organization and business challenges.